25 August 2022 - The inauguration ceremony of Hong Kong REITS Association Limited (HKREITA, or the Association) was held today at JW Marriott Hotel Hong Kong, with The Honourable Chan Mo-po, Financial Secretary of the Hong Kong SAR Government as the officiating guest. The Honourable Christopher Hui Ching-yu, Secretary for Financial Services and The Treasury, and Lui Tim-leung, the Chairman of the Securities and Futures Commission also graced the ceremony with their presence.

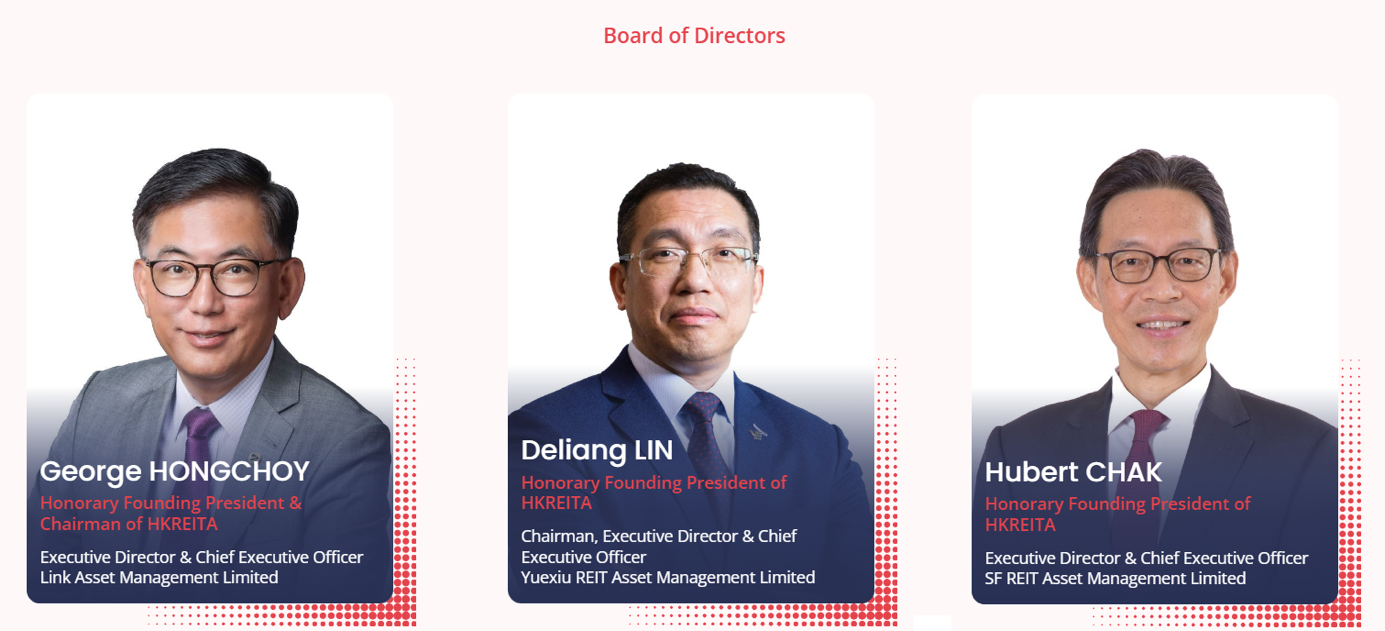

The three Honorary Founding Presidents of the Hong Kong REITS Association including George Hongchoy, Executive Director and CEO of Link REIT, Lin Deliang, Chairman, Executive Director and CEO of Yuexiu REIT and Hubert Chak, Executive Director and CEO of SF REIT, officiated the inauguration ceremony, with the presence of a number of representatives from the REITs industry, regulators and political and business leaders and luminaries, namely Salina Yan Mei-mei, Permanent Secretary (Financial Services) for Financial Services and The Treasury, and Joseph Chan Ho-lim Under Secretary for Financial Services and The Treasury, Julia Leung Fung-yee, Deputy CEO of the Securities and Futures Commission, Christina Choi Fung-yee, Executive Director (Investment Products) of the Securities and Futures Commission, Dr Au King-lun, Executive Director of Financial Services Development Council, Guo Jin, CEO of China Merchants Land Asset Management Company Limited, Keith Wu Shiu-kee, CEO of Henderson Sunlight Asset Management Limited, Christina Hau Shun, CEO of Eagle Asset Management (CP) Limited, and Kevin Leung Kwok-hoe, CEO of Spring Asset Management Limited.

The Honourable Chan Mo-po, Financial Secretary (third from right), Christopher Hui Ching-yu, Secretary for Financial Services and The Treasury (right), and Lui Tim-leung, the Chairman of the Securities and Futures Commission (second from left) joined the three Honorary Founding Presidents of the Association, George Hongchoy (third from left), Lin Deliang (second from right) and Hubert Chak (left) to officiate the inauguration ceremony of Hong Kong REITS Association.

The Honourable Chan Mo-po, Financial Secretary of the Hong Kong SAR Government

Government: Multi-pronged approach to support the development of REITs

The Hon Paul Chan Mo-po, Financial Secretary, said in his remarks that Hong Kong is one of the world's leading fund-raising centres and an important market for REITS in Asia Pacific Region, with 11 REITs listed on the Stock Exchange of Hong Kong amounting to the total market value of approximately HK$210 billion at the end of July this year, which represented more than fivefold increase as compared to 2005 when the REIT regime was first introduced to Hong Kong. Hang Seng REIT Index (Total Return Index) has risen close to seven times since its debut in 2008, far better than Hang Seng Gross Total Return Index which only increased by close to two folds in the same period. This is proof of the value and development potential of REITs.

REITs are an important part of Hong Kong's asset and wealth management industry. Last year, assets under management in Hong Kong amounted to HK$35.5 trillion, 65% of which were from overseas, which shows Hong Kong has what it takes to become the most preferred asset and wealth management hub in Asia. In addition, Hong Kong is already the largest hedge fund base in Asia and the second largest private equity fund centre.

The Hong Kong REITS Association aims to connect industry peers, promote robust development of Hong Kong's REIT industry and enhance Hong Kong's position in the global REIT market. Financial Secretary Paul Chan said that the Hong Kong REITS Association can provide industry players a good platform to cooperate and communicate with different parties and he hoped all concerned would make good use of this platform to facilitate new and more fruitful development of the REIT industry, asset and wealth management industry and Hong Kong society.

Co-founded by Link REIT (00823), Yuexiu REIT (00405) and SF REIT

The Hong Kong REITS Association is co-founded by Link Asset Management Limited (Link REIT, 00823.HK), Yuexiu Real Estate Investment Trust (Yuexiu REIT, 00405.HK) and SF Real Estate Investment Trust (SF REIT, 02191.HK).

George Hongchoy, Honorary Founding President of HKREITA and Executive Director and Chief Executive Officer of Link Asset Management Limited, said that the Association, which is the first and only non-profit industry organization focusing on promoting the Hong Kong REIT market, aims to connect and bring together more industry peers to work on enhancing Hong Kong's position in the global REIT market. At the same time, all sectors should cooperate through multiple channels to promote Hong Kong as the first choice for listing and trading of REITs, for example connecting and fostering exchange with the Mainland in order to provide investors with more choices for REITs.

Comparison with Singapore

Currently, there are 11 listed REITs in Hong Kong and about 44 listed REITs in Singapore (including 10 REITs with assets in Mainland China).

Lin Deliang, Honorary Founding President of HKREITA, and Chairman and Chief Executive Officer of Yuexiu REIT, said that while there are more than 40 listed REITs in Singapore, few of them have assets valued more than HK$30 billion. In terms of asset value, half of the top 10 REITs in Asia are Hong Kong REITs, and Yuexiu REIT has assets worth more than HK$45 billion, which has relatively strong influence among Hong Kong REITs.

Lin Deliang, Chairman, Executive Director and CEO of Yuexiu REIT

Comparison with Mainland China

There are currently 14 C-RElTs in Mainland China totaling a market value of RMB63.5 billion; the 11 REITs listed in Hong Kong reach a total market value of HK$210 billion.

Since the official launch of the first batch of publicly offered REITs in the Mainland last year, it has brought new inspiration and opportunities to the Hong Kong REIT market. Lin said that one of the Association's aspirations is to strengthen exchanges and linkages between relevant institutions in Hong Kong and Mainland China, attract more funds to flow into the REITs markets of both places, drive market growth, and provide investors with more choices of REIT products in the long run.

In regards to promoting the connection and fostering exchange between Hong Kong and Mainland REITs, although C-REITs and Hong Kong REITs are different, with the former being listings in form of companies and the latter in form of trusts, Lin believes breakthroughs are possible on the technical front and that, in the future, through vigorously fostering the collaboration with third parties, REITs in Hong Kong and the Mainland can develop together.

The Honourable Chan Mo-po, Financial Secretary (middle), Christopher Hui Ching-yu, Secretary for Financial Services and The Treasury (fourth from right), Lui Tim-leung, the Chairman of the Securities and Futures Commission (fourth from left), and Julia Leung Fung-yee, Deputy CEO of the Securities and Futures Commission (second from left), together with the three Honorary Founding Presidents of the Association, George Hongchoy (fifth from left), Lin Deliang (fifth from right) and Hubert Chak (third from left) as well as guests from other Hong Kong listed REITs attended the inauguration ceremony of Hong Kong REITS Association.

About Hong Kong REITS Association (HKREITA)

HKREITA is a collaborative platform of the city's real estate investment trusts (REITs) sector. The association brings together REIT managers, industry practitioners and professionals working in the REIT sector who share the association's vision to jointly promote the overall development of the REIT market in Hong Kong. HKREITA seeks to pool ideas and to serve as the representative voice of the REIT sector in Hong Kong, and works closely with policymakers and other stakeholders to boost Hong Kong's position in the global REIT market.