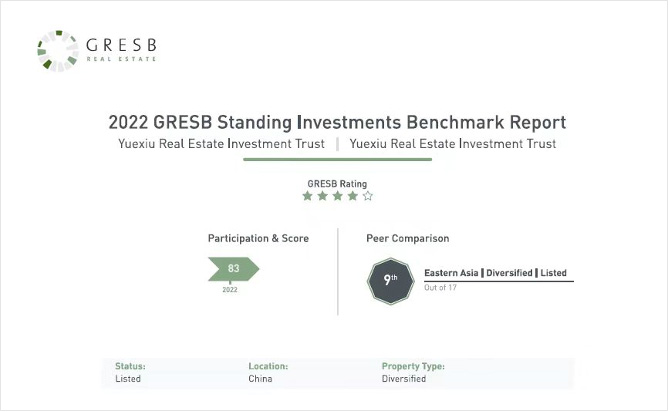

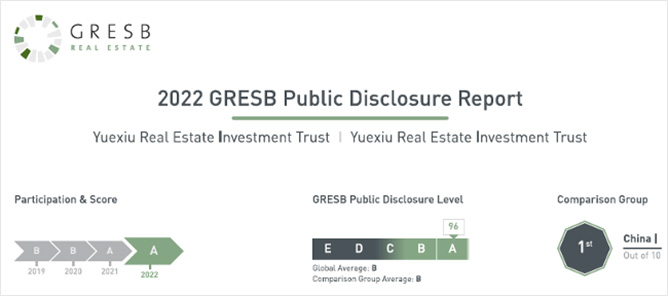

In October 2022, the Global Real Estate Sustainability Benchmark ("GRESB") announced the results of its 2022 rating, in which Yuexiu REIT (00405.HK) was upgraded to a Green Four-Star rating for its outstanding overall performance in this year's GRESB assessment. Yuexiu REIT also received an "A" rating for public disclosure (the highest level under this disclosure standard) for the second consecutive year, gaining high recognition from international benchmarks for its ESG performance!

After participating in the GRESB assessment for the first time in 2021 and receiving a Green Three-Star rating, Yuexiu REIT has diligently made continuous improvements across different key areas over the past year, including policies and targets, green building, energy consumption management, climate change adaptation, risk management and information disclosure. Yuexiu REIT has issued its first sustainability objectives, revamped property equipment and facilities to become low carbon, identified and assessed climate-related risks and opportunities, established a sustainability column on its official website, etc. In the 2022 assessment, Yuexiu REIT obtained full scores of 100 in policy, reporting, risk management, risk assessment, target management, and tenants and community. Its overall score increased by about 8% to 83 points. The public disclosure score also improved further to 96 points, ranking No. 1 in the China subcategory.

Yuexiu REIT was listed on the Hong Kong Stock Exchange in 2005. It is the world's first listed REIT to only invest in properties in Mainland China. Its nine properties are located in the core areas of Guangzhou, Shanghai, Wuhan and Hangzhou, with a range of property types including office buildings, retail malls, wholesale malls, hotels and serviced apartments. As of mid-2022, its property portfolio was valued at RMB42.38 billion, with a property ownership area totaling 1.18 million sq. m. Among the property portfolio, Guangzhou International Finance Center (GZIFC) has been certified by LEED EBOM V4 Platinum, BOMA China COE, and BOMA International 360 Performance Program, while Yuexiu Financial Tower has obtained LEED EBOM V4 Platinum Certificate, Platinum WELL Mid-term Certificate and China Green Building Three-star Certificate. In 2021, Yuexiu REIT signed the first RMB4.8 billion green club loan with DBS Bank (Hong Kong), which is an important milestone for its green financing.

As Mr. Lin Deliang, Chairman of the Board, Executive Director and Chief Executive Officer of Yuexiu REIT, shared in a forum, "To implement ESG, companies in the commercial real estate sector can start from three perspectives. Firstly, to commence from the development stage and adopt green building standards. Secondly, in the operation phase, it is necessary to sign a green pact and advocate low-carbon operation with the managed parties, including frontline operators, tenants, renovation workers and employees. Last but not least, the financing stage should make full use of green financing, including green bonds and green loans."

Since its listing, Yuexiu REIT has adhered to the "three-in-one" mode of integrating asset management and fund management, commercial operation and property management, and capital upgrading and asset upgrading. It has also set "environment win-win development", "society green development" and "economy inclusive development" as the three key principles of its sustainable development.

Yuexiu REIT has published the "Environmental, Social and Governance Report" (ESG Report) for six consecutive years since 2016. In early 2022, it launched a new sustainability column disclosing ESG-related information on its official website. The higher GRESB rating achieved by Yuexiu REIT demonstrates that its ESG management model and results have attained international standards. Yuexiu REIT will take this opportunity to continuously strengthen the management of all aspects of ESG and realize quality growth, with the hope of creating greater economic, environmental and social benefits for its stakeholders.